Originally published: November 2025 | Updated: December 2025

When you’re buying or selling a home, you may run into a document that can make or break your mortgage approval: the Uniform Residential Appraisal Report, or URAR.

The URAR is the standard form appraisers use to figure out your home’s market value. If you know how it works, you can spot issues before they slow down or even ruin your loan.

The URAR is a multi-page report (typically 4–7 pages, plus exhibits) that summarizes the property, market, and comparable sales using standardized UAD fields.

The URAR (Form 1004/Freddie Mac 70) is used for most one-unit, non-condo homes (including PUDs). Condos use Form 1073, manufactured homes use Form 1004C, 2–4 units use Form 1025, and co-ops use Form 2090.

Real estate agents know appraisal hiccups can seriously delay closings. If you learn to read your URAR, you can catch mistakes early and work with your appraiser to fix them before they snowball.

The Uniform Residential Appraisal Report is the standard form appraisers use to evaluate single-family homes for mortgage lending.

Lenders across the country rely on this format for consistent loan decisions, while other property types—condos, manufactured homes—get their own special forms.

Mortgage lenders use the URAR to assess risk before approving loans. The format makes it easy to compare homes and understand appraisal results.

Fannie Mae and Freddie Mac prescribe the form and the UAD data standard, which enforces consistent ratings, room/bath fields, and narrative elements nationwide.

Licensed appraisers fill out these reports during the buying process. They’ll inspect the property, check out comparable sales, and document everything in this standardized way.

The form matters because it protects both lenders and borrowers. Lenders want to know the home’s real value before handing out money. If a borrower defaults, the lender has to sell the place to get their money back.

Fannie Mae and other government-backed groups require this standardization. That way, every appraisal follows the same rules and quality checks, no matter where you are or who your lender is.

Using the same form everywhere helps catch errors and fraud. When all appraisers use the same format, it’s easier to spot odd numbers or questionable values.

The regular URAR form only works for single-family detached homes. Other property types have their own forms that fit their quirks.

Condominiums use Form 1073, which covers things like the homeowners’ association, shared spaces, and building condition. The appraiser looks at both the unit and the whole complex.

Manufactured homes get Form 1004C. That one deals with foundation types, transport damage, and whether the home meets HUD standards. These homes are built differently, so their value works differently, too.

Multi-unit properties (2-4 units) use Form 1025 because they bring in rental income. The appraiser checks both the property’s value and the rent you could get.

Cooperative apartments require Form 2090 because buyers purchase shares in a corporation rather than owning real property. That makes the valuation process different from a regular house.

Starting Sept. 8, 2025, the GSEs begin a Limited Production Period for the redesigned UAD 3.6 and a dynamic URAR, with broader adoption following in 2026. It modernizes fields and structure; it doesn’t change how value is determined.

Buying, selling, or refinancing? Get a precise, compliant valuation with Whitsitt’s certified residential appraisers—accurate URAR reports delivered quickly and clearly. Book your appraisal now.

The URAR uses a seven-page format that walks appraisers through property evaluation and market analysis.

Each page gathers key data points for the Uniform Appraisal Dataset lenders use to make decisions.

Page 1 outlines the basics of the appraisal process. The appraiser jots down property details such as address, legal description, and loan information.

Property Information Section includes:

The neighborhood section looks at the area’s features. Appraisers consider factors such as location, the level of development, and whether the area is growing or declining. They’ll also set neighborhood boundaries and note typical property values.

Contract Information covers sale terms when there’s a purchase involved. That includes the sale price, how it’s being financed, and any perks or concessions between the buyer and seller. The appraiser checks if these details affect the property’s market value.

The Property Rights section specifies the type of ownership being appraised. It could be fee simple, leasehold, or some other property rights that impact value.

Page 2 is where the real analysis happens, thanks to the sales comparison grid. Here, the appraiser compares your property to three recent sales of similar homes.

Each comparable sale gets listed with its address, how close it is to your place, and when it sold. Important property features are compared across several categories.

Comparison Categories include:

The appraiser makes a dollar adjustment for every difference between your home and the comparables. If your home is better in a category, it adds value. If the comparable is better, they subtract.

The Net Adjustment and Adjusted Sale Price columns show the final value each comparable suggests.

Pages 3 and 4 offer visual proof and the appraiser’s certification. The first photo shows the house from the street, giving a sense of curb appeal and condition.

Required Photos include:

The building sketch maps out the property’s layout and size. This helps calculate the gross living area and double-check the square footage.

A location map marks the subject property and the comparables. That way, you can see the appraiser chose comps from the same market area.

The appraiser certification section holds the appraiser’s signature and license information. Here, the appraiser confirms they personally inspected the property and followed professional standards.

Certification Requirements include:

The URAR wraps up with the appraiser’s final value opinion and their reasoning. Here, the appraiser explains how they weighed the comps to reach the final value.

Final Value Elements include:

The appraiser explains why they arrived at the final number. Sometimes, they put more weight on certain comps based on how similar they are or how recently they sold.

Additional Comments let the appraiser explain odd property features or market quirks. This helps readers understand what drove the final value.

The form ends with a spot for a supervisory appraiser’s review if the state requires it.

The effective date marks the day the property value applies, which isn’t always the same as the day the appraiser visited or completed the report.

“Desktop = Form 1004 Desktop / 70D; Hybrid variants are identified separately by the GSEs and rely on third-party data collection and specific certifications.

The Uniform Standards of Professional Appraisal Practice requires appraisers to report at least two dates: the “appraisal effective date” and the “report date.

Effective Date: The exact date the appraiser uses to determine the property’s value. It reflects the market and property as they existed then.

Inspection Date: The date the appraiser actually visits the property. Some organizations want this date reported since a property’s condition can change after the inspection.

Report Date: That’s the day the appraiser finishes and signs the final report.

These dates don’t always line up, especially with different appraisal types.

| Appraisal Type | Inspection Required | Effective Date Timing |

| Traditional 1004 | Yes (interior/exterior) | Usually inspection date |

| Desktop | No physical inspection | Based on available data |

| Hybrid | Exterior only or third-party | May differ from a limited inspection |

| Retrospective | May use past inspection | Historical date specified |

Under USPAP, the effective date anchors the opinion of value; the inspection and report dates can differ depending on scope (traditional, desktop, hybrid, or retrospective).

Desktop appraisals use public records, photos, and sales data. Hybrid appraisals blend limited inspections with data analysis.

Most mortgage lenders want full interior and exterior inspections for traditional 1004 URAR forms. They do this because investors and risk managers insist on it.

Physical inspections let appraisers check property condition and spot maintenance issues. They also confirm square footage measurements and can see things that photos just won’t reveal.

Lenders see thorough inspections as vital for loan security. Fannie Mae and Freddie Mac have strict rules that require physical property evaluations for most loans.

The inspection helps verify public record information and ensures the property matches the listing. Appraisers can catch safety hazards, code problems, or hidden changes while they’re there.

Need help reading or verifying your URAR report? Whitsitt reviews appraisals for accuracy and fairness so you can make informed property decisions. Schedule your consultation.

Appraisers follow a systematic approach on the URAR form. They use comparable sales and market-timing adjustments, and they stick closely to professional standards.

These steps ensure accuracy and consistency across all property evaluations.

The sales comparison approach is the core method for residential property valuation on the URAR. Appraisers select three comparable properties that recently sold in the same area.

Comparables need to be similar in size, age, and features. Ideally, they find homes sold in the last six months.

Appraisers adjust for differences between the subject property and each comp. Typical adjustments include:

Each adjustment shows up on the URAR grid. Appraisers add value for features the subject has that the comps don’t, and subtract value for features the subject lacks that the comps have.

The final adjusted values of all three comps help set the subject property’s value range.

Markets never really stand still, so that values can shift between the comp sale dates and the effective date. Appraisers make time adjustments to reflect these changes.

Rising markets mean appraisers add positive adjustments to older sales. If prices went up 6% a year, they’d tack on 0.5% per month to those comps.

Declining markets require negative adjustments. A sale from three months ago in a softening market might get a -2% tweak.

Appraisers use a few ways to spot market trends:

The UAD says appraisers need to back up time adjustments with market evidence. They can’t just go with a gut feeling.

Some stable markets don’t need time adjustments if recent sales already reflect the current reality.

The Uniform Standards of Professional Appraisal Practice (USPAP) and UAD requirements create consistency in residential appraisals. These standards protect everyone involved in a real estate deal.

USPAP sets ethical rules for appraisers. It requires independence, competence, and sound methods every time.

The UAD standardizes how data and reportsaret done. It puts certain info in the same place on every URAR form.

Key protections include:

These standards keep appraisers from inflating values just to hit a loan amount. They also help prevent lowball values that can hurt sellers.

Lenders count on standardized reports for consistent decisions. Homeowners get fair, supportable value opinions based on real market evidence—not just someone’s guess.

Appraisal mistakes can cost homeowners thousands and push back closing dates. The most significant problems usually involve square-footage errors, incorrect condition ratings, or outdated sales data.

Square footage errors are among the most common mistakes in appraisal reports. These happen when appraisers measure incorrectly or count areas that shouldn’t be included as living space.

ANSI Z765 matters: For Fannie-eligible assignments, appraisers must follow ANSI Z765-2021 for Gross Living Area, which impacts what counts as GLA vs. non-GLA (basements, sloped ceilings, garages). If your sketch/GLA looks off, ask whether ANSI was applied.

Homeowners should check that the total square footage matches their records. Garages, unfinished basements, and covered porches often get added by mistake.

Key areas to check:

A 100-square-foot error can swing a home’s value by $5,000 to $15,000, depending on the market. If there’s a significant discrepancy, homeowners can request a re-measurement.

Condition ratings affect property values directly. Appraisers sometimes get these wrong, and the difference between C3 (average) and C4 (below average) can mean a 5-10% value swing.

C3 properties show normal wear but are well-maintained. C4 properties need major repairs or updates to key systems.

Homeowners should carefully review the appraiser’s condition notes. Recent updates or new systems might not always get noticed.

Both quality and condition ratings appear on the report. Sometimes, a home with fancy finishes but poor upkeep earns a C4 rating, even if it looks nice at first glance.

Comps should be recent, nearby, and similar in size and features. Sometimes appraisers use sales from six months ago or homes miles away when better comps are available.

Red flags include:

Homeowners can look up recent neighborhood sales online. If there are better comps, they can ask the appraiser to reconsider.

Markets change fast, so older sales don’t always reflect current values. Sales from different seasons may not line up with today’s prices.

Whitsitt’s Residential Appraisal Services offers specialized valuation solutions for homeowners, attorneys, and real estate pros in the local market. Their team brings deep knowledge of property data and market trends to every report.

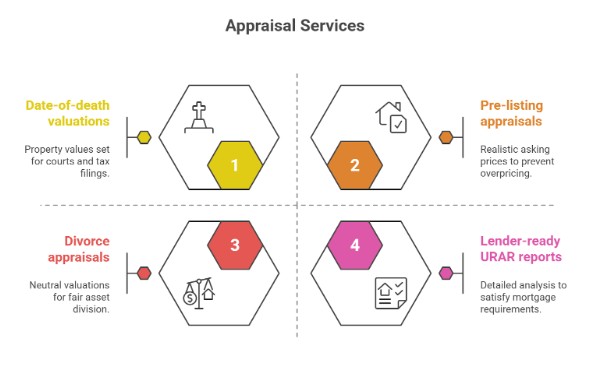

Whitsitt’s provides date-of-death valuations for estate and probate needs. These reports set property values as of specific dates for courts and tax filings.

Pre-listing appraisals help sellers pick realistic asking prices before listing. That can prevent overpricing and long waits on the market.

The company handles divorce appraisals for property splits. These neutral valuations give courts and attorneys the numbers they need for fair asset division.

Lender-ready URAR reports meet all mortgage requirements. These reports include detailed analysis, comps, and market assessments to satisfy underwriters.

Each appraisal type follows strict guidelines and reporting rules. Reports come with photos, sketches, and clear explanations of the value conclusions.

Whitsitt’s appraisers keep up-to-date databases of local sales and market trends. This makes their valuations accurate and grounded in current neighborhood conditions.

The company prides itself on transparent reporting with clear explanations for every value call. Reports break down the reasoning and provide straightforward market analysis.

Fast turnaround usually means 3-5 business days for standard appraisals. Rush options are available if you’re on a tight timeline.

Licensed appraisers complete annual continuing education. They stay on top of changing rules and market shifts that impact property values.

Want to schedule an appraisal? You can call for a quick chat or fill out an online request form.

During the first conversation, we’ll talk about what you need and when you need it.

Required information includes:

It usually takes about a day or two to confirm your spot.

We’ll send you a precise fee quote before starting anything.

Review requests for existing appraisals? Just send over the original report.

Our team digs into the details—methodology, comparable sales, and value conclusions—to verify accuracy and compliance.

The URAR form sits at the heart of most residential property appraisals. If you really get to know this document, you’ll have a much easier time navigating the whole buying or selling process.

Some big perks of understanding the URAR:

The new URAR appraisal form really shakes up the mortgage process. It brings more transparency for everyone and just handles different property types better than the old forms ever did.

Homeowners should review their appraisal reports closely. If something feels off or confusing, just ask questions—don’t be shy.

The URAR dives deep into property condition, location, and those all-important comparable sales. That info directly affects the final value.

The new, data-driven URAR is a real step up from what we had before. It provides a clearer, more thorough view of a property.

If you take a little time to learn about the URAR, the whole real estate process gets less stressful. Maybe not easy, but definitely less of a mystery.

Whitsitt delivers clear, USPAP-compliant appraisal reports using the URAR form to help you secure financing, settle estates, or plan sales confidently. Contact us today.

What does URAR stand for in an appraisal?

The URAR stands for Uniform Residential Appraisal Report (Form 1004). It’s the industry-standard form used to report the market value of single-family homes during mortgage, refinance, or estate transactions.

Who uses the URAR form and why?

Lenders, underwriters, and appraisers use the URAR Form 1004 to ensure a consistent, credible assessment of a property’s value under Fannie Mae and Freddie Mac guidelines. Homeowners benefit from its uniform structure and transparency.

How many pages are in a typical URAR report?

Most URAR reports are 5–7 pages long, including property data, market analysis, comparable sales, and supporting exhibits such as photos, sketches, and certifications.

What are “C” and “Q” ratings on the URAR form?

“C” (Condition) and “Q” (Quality) ratings are standardized UAD codes that describe a home’s physical condition and construction quality. For example, C1 indicates new construction, while C6 signals significant defects.

Can I request a copy of my appraisal report?

Yes. Under federal law, your lender must provide a copy of the completed appraisal within three business days of receiving it, even if the loan doesn’t close.

What if the URAR appraised value seems too low?

You can file a Reconsideration of Value (ROV) through your lender. Provide factual evidence such as updated square footage, recent comparable sales, or documented improvements for review.

Does the new URAR redesign affect my home’s value?

No. The UAD/URAR modernization (2025–2026) only updates the report’s format and data structure for clarity. It does not change how appraisers determine market value.