Originally published: August 2025 | Updated: December 2025

When Illinois couples go through divorce, they often overlook a significant decision: whether to hire a single neutral appraiser or obtain separate appraisals for each spouse.

This choice can significantly impact the accuracy of property valuations and ultimately determine the cost of the divorce.

The choice between single and joint appraisers can significantly impact everything from settlement negotiations to the outcome in court.

Property valuation during divorce isn’t always straightforward, since what you paid for something long ago might be miles off from its current value.

It is helpful to understand how Illinois family courts approach appraisal disagreements and which types of assets require different strategies.

The right appraiser choice can make the divorce process smoother and help ensure fair property division that protects both sides’ finances.

A single appraiser means one neutral professional values all the marital property for both people in an Illinois divorce. This isn’t the same as each spouse getting their appraiser.

The single appraiser steps in to give an unbiased property valuation for dividing up assets. They examine real estate, personal property, and any other assets that require division.

| Process Step | Description |

| Appointment | The court appoints or both parties agree on one appraiser |

| Property Access | Appraiser inspects all marital assets requiring valuation |

| Report Creation | A single comprehensive report covers all properties |

| Court Submission | One appraisal report is used for property division decisions |

Using professional appraisers in Illinois divorce cases requires careful consideration of whether you want one or more experts involved.

This approach helps because it eliminates conflicting valuations. When appraising personal property in divorce cases, separate appraisers usually come up with very different numbers.

The single appraiser needs the right Illinois license. Illinois real estate appraisers hold titles such as Associate Trainee, Certified Residential Appraiser, or Certified General Appraiser.

This method provides everyone, including spouses and the court, with a single authoritative valuation for dividing property.

In a joint appraiser approach, both spouses hire one neutral expert to value their assets. That person works for both sides, rather than each spouse bringing in their own appraiser.

The separate appraiser approach is the old-school way. Each spouse brings in their own expert to value the same asset or business. These two appraisers often reach different conclusions about the value of things.

| Joint Appraiser | Separate Appraisers |

| One neutral expert | Two competing experts |

| Shared cost | Each party pays separately |

| Single valuation report | Two different valuations |

| Less conflict | More adversarial |

Joint appraisers are most effective for dividing assets in smaller cases or family businesses. They help keep costs and conflict down.

Separate appraisers make sense when spouses can’t agree on property values. Each expert stands up for their client in court.

The approach you pick changes how appraisers handle dividing property in divorce. Joint experts aim for a fair market value, while separate experts may push values that benefit their clients.

Trust and cooperation between spouses usually decide which approach actually works for a given case.

Whitsitt & Associates provides neutral divorce property appraisals trusted by couples and attorneys across Illinois. Need help valuing your marital assets? Contact us today.

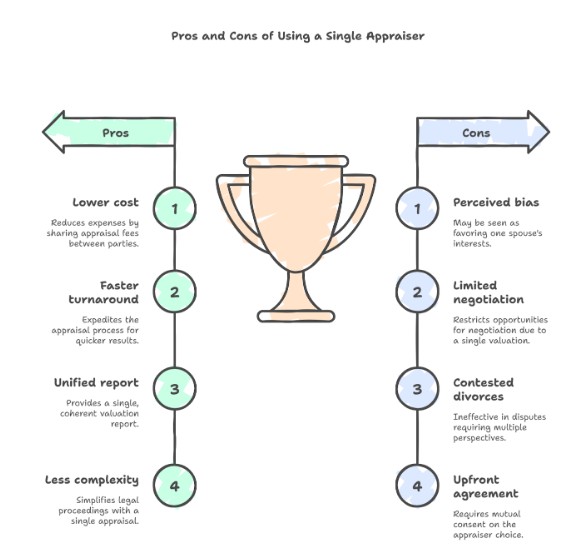

Using a single appraiser brings cost savings and efficiency, but some individuals worry about fairness. It really comes down to how much the property is contested and if both sides trust the neutral expert.

Hiring a single appraiser costs significantly less than hiring two. Couples split one fee instead of each paying their own pro.

Things move quickly with just one appraiser. There’s no juggling multiple schedules or waiting on different people to finish reports.

Cost Comparison:

When both spouses accept a neutral opinion, there’s less arguing over property values. You skip the drama of duelling experts.

Professional fees can pile up with multiple appraisers. A neutral expert keeps expenses down and still delivers an accurate report.

Single appraisers are a good fit for straightforward cases. You get objective valuations without the headache of comparing two experts’ takes on what matters most.

Sometimes, even after agreeing on the appraiser, one spouse begins to doubt their neutrality. That can add to the stress of an already tough situation.

The appraiser’s method may lean toward a particular valuation style. One spouse could feel shortchanged if the approach doesn’t reflect their financial input.

Potential Issues:

Complicated marital property often requires multiple perspectives. When two appraisers examine the same property, their values can differ significantly due to their distinct backgrounds and appraisal methods.

Specialized or high-value assets require deep expertise. A single appraiser may not possess the expertise needed for unique property types that necessitate careful analysis of finances and ownership history.

| Pros | Cons |

| Lower cost (shared fee) | May feel biased toward one spouse |

| Faster turnaround | Less useful in highly contested divorces |

| One unified report | Limited negotiation leverage |

| Less courtroom complexity | Both parties must agree on the appraiser up front |

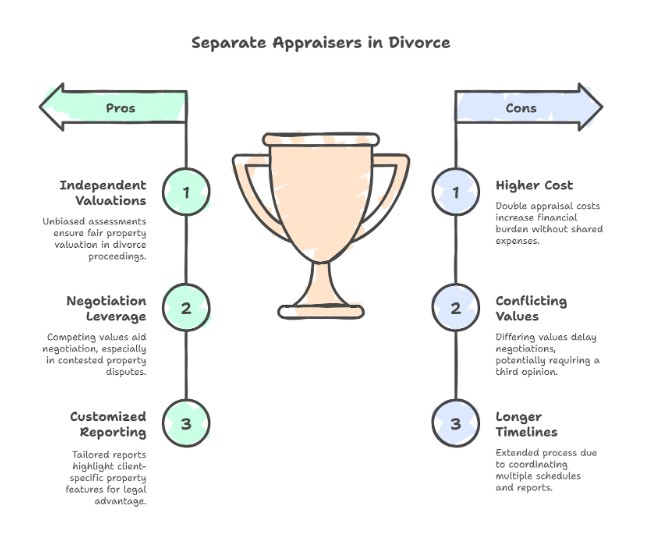

Each spouse can bring in their own appraiser for independent property valuations during the divorce process.

This can give you more negotiating power and an unbiased take, but it also means higher costs and sometimes conflicting values.

Each spouse gets their own professional’s take—no split loyalties. The appraiser only answers to their client, not both sides.

This helps avoid concerns about objectivity being diluted. Each expert can zero in on their client’s interests.

Separate appraisals give each spouse a bargaining chip. If one appraisal comes in higher, that spouse can push for better terms.

Both spouses can hire separate appraisers to back up their own positions. This is especially helpful in contested divorces with significant disagreements over property value.

Appraisers can highlight features that benefit their clients. Maybe one highlights recent upgrades, while the other points out repairs needed.

Reports can address legal concerns that matter most to each spouse. This targeted info can be a game-changer in negotiations.

Hiring two appraisers means paying twice. Professional appraisals typically cost between $300 and $600 each for homes.

Appraisal costs might be split if you use one expert, but separate appraisers kill that cost-sharing perk.

Two appraisers often don’t agree on the same property’s value. Sometimes the gap is small, but it can be thousands apart.

Conflicting numbers make negotiations challenging and may require the court to call for a third appraisal or select between experts.

Coordinating two appraisals takes extra time. Each expert requires access and sufficient time to complete their work.

This can prolong the divorce and increase legal fees.

| Pros | Cons |

| Independent valuations from each party | Double the cost |

| Leverage for negotiation or trial | Conflicting reports may need a third appraisal |

| Better for complex or disputed assets | Takes longer to reconcile values |

| Each appraiser works only for their client | Potential to inflame tension |

When appraisers assign different values to the same property, Illinois courts must intervene to ensure equitable distribution remains fair. Judges actually have several ways to address these valuation gaps.

Court Options for Resolving Appraisal Conflicts:

When values are far apart, courts dig into the credentials and methods of each appraiser. Judges look at comparable sales, inspection reports, and the valuation techniques each professional used.

Factors Courts Consider:

| Element | Impact |

| Appraiser qualifications | Certified professionals carry more weight |

| Methodology used | Courts lean toward standard approaches |

| Recent comparable sales | Current market data matters most |

| Property condition assessment | Detailed inspections get extra points |

When appraisals are off by more than 10-15 percent, Illinois judges usually want an explanation. The court might ask appraisers to defend their numbers in writing or even under oath.

Chicago family attorneys often recommend obtaining multiple appraisals for high-value properties to minimize court delays. This helps everyone see the possible range before things get heated in court.

Need an accurate valuation during your divorce? Whitsitt & Associates delivers fast, court-compliant real estate and property appraisals. Schedule with our team now for peace of mind.

Different assets require different appraisal approaches, depending on their complexity and potential for dispute.

If you’ve got straightforward, jointly-owned stuff, one appraiser usually does the trick. Messier or more valuable assets? You’ll probably want separate professionals.

The marital home almost always works best with just one appraiser. Most couples agree to hire a single, licensed real estate appraiser to determine the fair market value.

It saves money and time. A single appraisal costs around $300-$600, while two separate ones can double that amount.

Jointly-owned investment properties also fit this single-appraiser mold. These assets are part of the division of property process, and there’s not much to argue about ownership.

Benefits of single appraisers for real estate:

Most Illinois courts go for single appraisals when it comes to basic real estate. The appraiser provides a neutral number that both parties can use during negotiations.

Business interests? You’ll want separate appraisers. Each spouse needs their own business valuation expert to protect their stake.

Separate property, such as inherited items, often requires individual appraisals as well. Perhaps one spouse claims the asset increased in value due to marital contributions, while the other disagrees. That’s where separate opinions matter.

Collectibles—think art, antiques, rare finds—can swing wildly in value depending on who’s doing the appraising. Separate experts help here.

When separate appraisers are essential:

Community property states play by different rules than Illinois. However, in this case, if the stakes are high, independent valuations protect both parties.

Retirement accounts sometimes need separate analysis, too, especially if it’s unclear who contributed what. The more complex the asset, the more likely you are to need a thorough individual review.

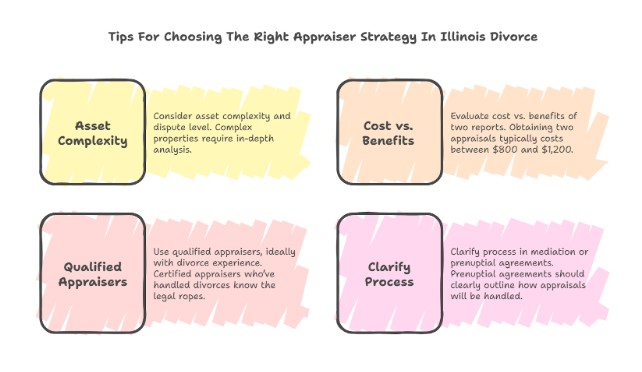

The complexity of your assets and how much you and your spouse disagree will shape whether you go with a single or joint appraiser. Cost, qualifications, and clear ground rules are crucial for a fair process.

Complex properties require in-depth analysis, and it’s usually worth obtaining multiple professional opinions. High-value homes, unique architecture, or properties with major upgrades can be challenging to value.

Simple Properties tend to be standard single-family homes in established areas with plenty of recent sales to compare. These usually work fine with just one appraiser.

Complex Properties might include:

If the divorce is high-conflict, hiring separate appraisers can help maintain fairness and prevent accusations of bias. When spouses can’t agree on value, each side hiring their own appraiser tends to cool things down.

On the other hand, if you’re both on good terms, a single appraiser is usually sufficient and saves money.

Obtaining two appraisals typically costs between $800 and $1,200, while a single appraisal ranges from $400 to $600.

The extra cost may make sense for properties exceeding $300,000 or if one spouse has significantly more financial resources than the other.

Cost Factors Include:

The greater the property value, the more it matters to get it right. A $50,000 difference on a $500,000 home can really impact the distribution of proceeds.

For high-net-worth couples, the additional cost usually feels worthwhile for the peace of mind it provides. With lower-value properties, you might skip the second appraisal unless there’s a serious disagreement regarding valuation.

When Two Appraisals Make Sense:

Certified appraisers who’ve handled divorces know the legal ropes and emotional landmines. They’ll write detailed reports that satisfy the court.

Look for appraisers with these qualifications:

Seasoned divorce appraisers know how to keep things professional, even when emotions run high. Unbiased reports are crucial for dividing assets fairly.

Red Flags to Avoid:

Ask appraisers about their divorce work and get references from attorneys who’ve hired them. It’s worth the extra step.

Prenuptial agreements should clearly outline how appraisals will be handled to avoid disputes later. Setting clear rules about single versus joint appraisers saves a lot of headaches if you end up divorcing.

Mediation Considerations:

Prenuptial agreements can even specify which appraisers or companies to use. Some couples believe that any property over a certain value requires two appraisals. Others just want to know that the process is fair and clear.

Agreement Elements to Include:

Having these details in writing makes the entire property valuation process significantly less stressful if things ever go awry.

Choosing between single and joint appraisers really depends on each couple’s unique situation. The decision can change both the cost and the accuracy of property valuation in Illinois divorce cases.

Single appraisers make sense when:

Joint appraisers are appropriate if:

Illinois couples need to seriously consider their finances and how they interact with each other. Property division in Illinois follows the principle of equitable distribution, so obtaining a solid valuation is crucial.

The appraiser’s credentials probably count more than the method. Licensed folks know Illinois real estate and what courts expect. They’ll also handle the documentation judges want to see.

How well spouses communicate with each other plays a significant role. If they’re on decent terms, a single appraiser usually works. If not, having each person’s own expert can save headaches.

Whether you’re working cooperatively or through litigation, Whitsitt & Associates offers detailed Illinois divorce appraisals you can rely on. Reach out now to schedule your appointment.

Can each spouse hire their own appraiser in an Illinois divorce?

Yes. In Illinois, each spouse has the right to hire their own appraiser to obtain an independent valuation of marital property during the divorce process.

What is the benefit of using a joint appraiser in a divorce?

A joint appraiser reduces costs and avoids conflicting valuations by providing one shared report that both spouses can agree on.

Do Illinois courts accept separate appraisals from each spouse?

Yes. Courts often review both appraisals, and if values conflict, they may average them, appoint a third appraiser, or hold a hearing to resolve the difference.

Is using two appraisers more expensive than hiring one?

Yes. Hiring two separate appraisers usually means each party pays full appraisal fees, potentially doubling the cost compared to using a joint expert.

What types of assets usually need separate appraisers?

Complex assets, such as businesses, inherited property, or rare collectibles, often require independent appraisals to reflect each spouse’s financial interest fairly.

Can conflicting appraisals delay a divorce in Illinois?

Yes. Discrepancies between valuations may require negotiation, mediation, or even court intervention, potentially prolonging the divorce timeline.

How do I know if I need a joint or separate appraiser?

If the divorce is amicable and the property is straightforward, a joint appraiser may be the best option. In high-conflict or complex asset cases, separate appraisers offer stronger protection.