Originally published: July 2025 | Updated: January 2026

Getting ready for a Central Illinois home appraisal inspection can feel overwhelming, especially if you are not sure what will happen during the process.

During a typical home appraisal in Central Illinois, the appraiser will inspect the home’s condition, square footage, features, and any recent updates or repairs.

This step is important because it helps lenders decide if the home is worth the price you’ve agreed to pay or receive.

The appraiser will walk through each room, look at the layout, and note the number of bedrooms and bathrooms.

They will also inspect the foundation, roof, plumbing, and other critical systems to ensure everything is in good working order.

Appraisals set the foundation for most home purchases and refinances across Central Illinois.

They ensure that both lenders and buyers are making decisions based on the fair and current value of a property.

A licensed appraiser is required when someone applies for a mortgage or wants to refinance a home.

The main job of the appraiser is to provide an unbiased opinion of a home’s value. This protects the lender from lending more than the property is worth.

Banks in Central Illinois rely on this value to decide how much money to lend.

If the appraisal comes in lower than the sale price or refinance amount, it can affect loan approval or terms.

This makes the appraisal a critical step in the mortgage process.

The cost of a home appraisal in Illinois usually ranges from $350 to $500 for a standard residential property.

For rural properties, appraisal fees may be higher due to the additional travel required and the increased complexity of valuing homes with extensive land tracts.

Lenders sometimes add an appraisal travel fee for homes located in areas far from city centers or in remote rural locations.

Appraisals also have a direct impact on the local real estate market.

In Central Illinois, they help set price expectations for both buyers and sellers.

When an appraiser considers recent home sales, upgrades, and neighborhood trends, their report reflects current market demand.

If local home values rise or fall, appraisals can prompt sale prices to adjust rapidly.

This is especially true in slower rural markets, where fewer sales make pricing more uncertain.

Accurate appraisals ensure that homes are neither over- nor under-priced for the area, and help maintain market stability.

For rural properties, unique features—like acreage, barns, or farmland—require special consideration.

Rural appraisals often cost more because the process takes more time and knowledge.

Sometimes, extra travel costs are included when appraisers need to drive long distances in rural parts of Illinois.

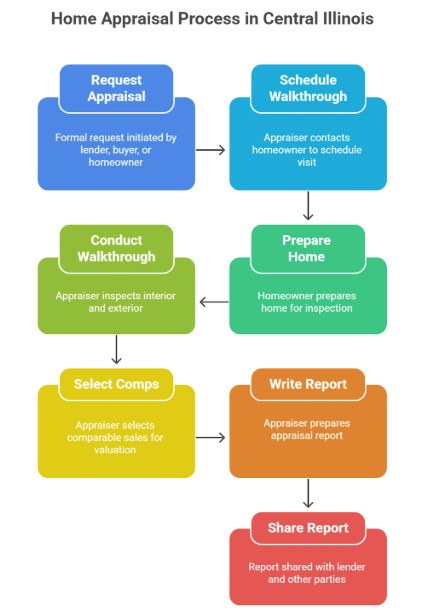

Getting a home appraisal in Central Illinois involves several key steps. Each phase plays a specific role in determining the market value of a home and ensuring the process is accurate and fair.

Before the inspection, a formal request for an appraisal is made. This is typically initiated by the lender, buyer, or occasionally the homeowner.

Once this happens, the appraiser will contact the homeowner to schedule the walkthrough.

It is important to give the appraiser access to the entire home, including any basements, attics, and garages.

Having important documents ready, such as records of recent improvements or repairs, can help the appraiser do a more thorough job.

Cleaning the house and ensuring things are tidy is recommended, but minor cosmetic issues are less important than major structural ones.

Appraisers in Central Illinois often do background research before visiting.

This may include researching property details, reviewing county records, and analyzing the local market.

These tasks help the appraiser prepare for the visit and give context for what they will see on-site.

Homeowners should be prepared to answer basic questions about upgrades, the age of their mechanical systems, and any other important features.

During the on-site walkthrough, the appraiser will take a thorough look at both the interior and exterior of the house.

Most walkthroughs average about an hour but can range from 30 minutes to several hours, depending on the property size and complexity.

The appraiser will measure all rooms, living spaces, and finished areas to figure out the home’s square footage.

They will take photos of important spaces, both inside and out, to help with the report.

Key systems, such as heating, air conditioning, electrical, and plumbing, are visually inspected, but in a less detailed manner than a traditional home inspection.

Areas such as the roof, foundation, and windows are visually inspected for obvious issues, as these can significantly impact value.

The appraiser will also look for any signs of major repairs or updates.

Outdoor factors, such as the yard, driveway, and overall setting, are also taken into account.

After completing the walkthrough, the appraiser selects comparable sales, also known as “comps,” from nearby areas.

This step is crucial in determining the home’s market value.

In Central Illinois, comps should be drawn from the sales of similar homes in the same neighborhood or school district, and ideally from the last 6 to 12 months.

The appraiser looks for similarities in square footage, age, lot size, and style.

They adjust for any differences between the comps and the subject home.

For example, if the appraised home has a new garage but the comp does not, the appraiser adds value for this feature.

The process focuses on sales that best represent the local market and current trends, so homes that are too old or far away are less useful.

This helps make sure Central Illinois real estate comps are as accurate as possible.

Once the inspection and comparison steps are finished, the appraiser writes a report.

The report includes photos and a diagram that shows the home’s floor plan and layout.

It explains how the appraiser arrived at the value, lists the chosen comps, and explains any adjustments made.

The report discusses conditions, upgrades, local market data, and special features, highlighting both strengths and issues.

The report is shared with the lender and may also be sent to buyers or sellers if required.

It must follow state and federal guidelines for accuracy and fairness.

The timeline for a home appraisal in Central Illinois depends on market conditions, location, and the property’s size.

Most appraisals are scheduled within a week of the request.

The inspection itself usually takes about 1 hour, though larger or more complex homes may need longer.

After the visit, the final report is typically completed within 3 to 7 business days, although it may take longer during periods of high activity.

In total, the entire home appraisal timeline in Central Illinois typically ranges from approximately 7 to 14 days, from start to finish.

Delays can occur if there are issues obtaining comps or if additional information is required.

Whitsitt & Associates offers trusted home appraisal inspections throughout Central Illinois, helping homeowners and buyers get accurate property values with fast turnaround. Schedule your appraisal today by contacting us.

Taking a few steps before the appraisal inspection can help a homeowner present their property in the best possible way.

Small details, good documentation, and a little effort can help the appraiser see the home’s true value.

Start by gathering any paperwork that shows important information about the home.

This includes proof of recent repairs, receipts for upgrades, warranties for new appliances, or records of roof work.

If the owner has a property survey, old appraisals, or tax records, these papers should also be ready.

These documents make it easier for the appraiser to confirm important details.

For example, a recent HVAC replacement or a new water heater could impact the appraised value.

A full set of documents helps support the home’s condition and can be used to address questions that may arise during or after the appraisal inspection.

It is helpful to write down all upgrades or improvements made since moving in.

Owners should provide specific details, including the date, cost, and nature of each project, to ensure transparency and accountability.

Include work such as kitchen remodels, new windows, finished basements, or updated bathrooms.

Smaller touches, like new fixtures or flooring, can also be important.

Appraisers rely on these details to compare the home to others in the area.

If an owner has added energy-efficient windows or replaced the siding, this can add value.

Documenting home upgrades for the appraisal is especially important for homes in Central Illinois, where property types and conditions often vary.

Preparing a printed or digital list makes sure nothing is forgotten.

Cleaning and decluttering help create a better first impression and can even affect how the overall condition of the property is judged.

Focus on the main living areas, kitchen, bathrooms, and bedrooms. Clear away excess items from countertops, tables, and floors.

Tidy or remove clutter in closets and storage areas to show the amount of usable space.

In Illinois, appraisers typically follow a checklist that examines the home’s structure and features.

However, a clean environment allows the appraiser to see features and assess the true condition without distractions.

This can only help during the process and is an easy step to take, even the day before the appointment.

On the day of the inspection, the homeowner should be present if possible. This enables them to answer questions, highlight updates, and draw attention to key features.

It is a good idea to walk through the property with the appraiser and point out any special amenities or recent improvements. If the appraiser notices something they are unsure about, having the owner nearby means they can explain right away.

Mention any neighborhood perks, such as a nearby park or school, since these can help the appraiser understand the property’s full context.

While appraisers work independently, friendly communication and quick answers can make the appointment smoother, according to inspection preparation tips.

Do you need a detailed, unbiased home appraisal report in Champaign or the surrounding area? Whitsitt & Associates delivers clarity you can rely on—get started with a quick call or message us now.

Several challenges can arise during a home appraisal inspection in Central Illinois. Being aware of these issues helps sellers and buyers prepare, allowing the process to proceed more smoothly and efficiently.

One frequent hurdle is trouble accessing the home or certain parts of it. If an appraiser can’t enter all rooms, open garages, reach the basement, or inspect the attic, this can delay the entire process.

Locked doors, blocked hallways, or cluttered rooms can all cause problems. Appraisers must inspect every area of the house to confirm its condition and gather the necessary details.

If pets are loose or security systems are left on, this can slow down the process or force the appraiser to skip certain parts of the inspection. To avoid delays, it’s a good idea for owners to unlock every area and clear paths before the appointment.

Keeping pets secured and ensuring that lights work in every room will help the appraiser complete the job efficiently.

Missing or incomplete paperwork can hold up the inspection process. Appraisers may request recent updates, receipts for renovations, documents for new systems, or details about additions such as decks or finished basements.

Homeowners who can’t show proof of work or permits may find that the improvements don’t add as much value as expected. Lenders, too, may need to see that any work was done with the right approvals.

A simple checklist can help:

Having these items ready in advance lets the appraiser confirm new features and saves time.

Very unique homes—such as old farmhouses, historic buildings, or custom builds—can cause extra work for appraisers. These properties may have unusual sizes, layouts, or features that make them difficult to compare to other homes in the area.

For example, a home with a working barn, a geothermal heating system, or handcrafted woodwork requires closer study and sometimes specialized valuation methods.

This often leads to more questions and back-and-forth between the appraiser, lender, and homeowner.

Appraisers typically rely on recent sales of similar homes; however, when few or no such sales exist, the inspection can take longer and require additional information. Owners can help by providing records of repairs and upgrades for custom features.

Appraisals rely heavily on recent sales (comparables, or “comps”) of similar homes in the surrounding area. If the market has been slow or there aren’t many similar houses, it becomes difficult for the appraiser to set a value.

Fast market changes or dips in local sales can also make it harder to determine current values. Appraisers must use what is available, but they may have to expand their search or rely on older data.

This can result in values coming in lower or taking longer to finalize. Sellers are encouraged to stay aware of local market trends. Sometimes, it helps to prepare thoughtfully for inspections and appraisals by discussing recent sales with a real estate agent before the assessment.

Once the appraisal inspection is complete, important steps follow that can affect the approval of your mortgage and the progress toward closing. Buyers and sellers should be prepared to carefully review the appraisal report, address any potential issues with the appraised value, and understand how the results can impact the final closing process.

After the appraisal inspection, the lender will receive a detailed appraisal report. This report estimates the home’s fair market value and notes any property conditions that may concern the lender.

In most cases, buyers are sent a copy for review. It’s important to read the report carefully.

Look for information about the home’s condition, recent sales comparisons, and the method used to determine its value. This is your chance to confirm the appraisal reflects the property’s true value and that there are no mistakes or missing details.

If something seems wrong or unclear, please contact your real estate agent or lender immediately to discuss it. Be aware that the report may impact whether the lender approves your loan amount.

If the appraised value matches or exceeds the purchase price, the process can move forward smoothly. If the value is lower than the agreed price, things can become more complicated for both the buyer and seller.

A low appraisal can present a major obstacle. When the home’s appraised value is below the contract price, the lender may not approve the full amount of the mortgage.

At this point, there are several options:

In Illinois, appealing a low appraisal is possible but requires strong support, such as showing more accurate sales data or correcting mistakes in the report. Appraisal contingencies in the contract protect buyers by allowing them to cancel the sale or renegotiate if the appraisal value is low.

Working closely with real estate agents and lenders is vital during this stage.

Once the appraisal is accepted and any issues are resolved, the file returns to the lender’s underwriting department.

Underwriters give the final review of the buyer’s loan application, including the appraisal and all other required documents.

If everything is in order, the lender issues a “clear to close.” The buyer and seller can then set a closing date to sign paperwork and transfer ownership.

Delays can occur if the lender requires additional documentation or clarification on the appraisal report. Staying in close contact with your lender and real estate agent helps prevent last-minute surprises.

It’s essential to respond promptly to requests to maintain a smooth workflow.

Central Illinois has its housing market trends. Local factors, such as property age and typical home features, often affect the way values are determined.

Appraisers in Central Illinois closely follow the USPAP appraisal guidelines, which help maintain a fair and uniform process throughout the region.

However, some details—such as the types of homes and upgrades typically found in this region—can result in slight variations in property assessments.

Unlike a home inspection, which checks for repairs and safety, an appraisal inspection in Illinois focuses on determining the home’s value for the lender and buyer.

This difference is important because local appraisers use recent sales in the same area, or “comps,” which can vary a lot from one town to the next.

Key factors that might differ in Central Illinois include:

In Central Illinois, weather and climate can also impact home values. For example, a finished basement may be more valuable due to its seasonal appeal.

Appraisers gather data on all these points during their inspection process, making each report specific to the area.

The goal is always to deliver an accurate value for the home, matching the standards set by the industry nationwide.

It helps establish a fair market value and provides everyone with a better understanding of the property.

During the inspection, the appraiser will look at the home’s condition, size, and features.

They also review the local area and any upgrades or repairs made to the property.

A detailed inspection protects everyone during the sale. Being ready helps the entire process move smoothly.

From pre-listing valuations to mortgage appraisals, Whitsitt & Associates is the go-to expert for home appraisal inspections in Central Illinois. Schedule your consultation with our certified appraisers today by contacting us.

What does a home appraiser look for during an inspection?

A home appraiser assesses the property’s condition, size, location, and key features. They examine both interior and exterior elements—such as the foundation, roof, HVAC system, square footage, and recent upgrades—then compare them to similar local sales to estimate the market value.

How long does a home appraisal inspection take?

The on-site home appraisal typically takes 30 to 60 minutes. However, the entire process—from scheduling to receiving the final report—can take 5 to 15 business days, depending on complexity and local market conditions.

How much does a home appraisal cost in Central Illinois?

In Central Illinois, the average home appraisal costs between $350 and $500. Rural locations or unique properties may incur additional fees due to the time required for travel or complex valuation requirements.

What should I do to prepare my home for an appraisal?

To prepare, clean the home thoroughly, make minor repairs, and ensure access to all rooms. Provide documentation of recent improvements, permits, and a list of upgrades to help the appraiser accurately assess value.

Can a messy house affect the home appraisal value?

A cluttered or dirty home typically won’t reduce appraised value, but it can make it harder for the appraiser to inspect or photograph key areas. A clean, well-maintained appearance supports a smoother process and a better first impression.

What happens after a home appraisal inspection?

After the inspection, the appraiser completes a formal report using comparable sales, condition notes, and valuation methods. The report is submitted to the lender, and the buyer typically receives a copy within 7 to 10 days.