Originally published: August 2025 | Updated: January 2026

When you’re named an executor in Illinois, you’re handed the big job of managing someone’s estate after they pass away. One of the first hurdles? Getting accurate appraisals for their property and belongings.

Executors in Illinois need to complete estate appraisals within 90 days of being appointed by the probate court. Doing this correctly protects both the estate and you, the executor, from legal headaches.

Your job as executor includes determining what everything is worth before you pay debts or distribute assets to heirs. This isn’t just about guessing values or checking Zillow.

You need to know which items require professional appraisers, how to document values, and when to file paperwork with the court.

If you get estate appraisals wrong, you might face angry family members, tax issues, or even legal trouble.

This guide breaks down each step of the appraisal process, from selecting which assets require a professional to handling the 90-day deadline.

An estate appraisal is a professional assessment that determines the fair market value of a deceased person’s assets. That includes real estate, personal property, investments, and any other assets of value.

Estate executors in Illinois need appraisals to fulfill their legal duties. You’re expected to manage the estate in accordance with state laws and the terms of the will.

In Illinois, estate administration means reporting the estate’s value to the probate court. Real estate almost always needs a professional appraisal as part of this inventory.

The appraisal locks in values as of the date of death. That’s important because property values can fluctuate after someone passes away.

Courts use these numbers to calculate estate taxes and verify that you’re managing things properly. If you skip accurate appraisals, you’re opening yourself up to legal problems and maybe even personal liability.

Illinois law requires executors to obtain estate appraisals within specific timeframes during probate. The deadlines depend on the type of asset and the court’s requirements.

Executors must file an inventory of estate assets within 60 days of receiving Letters Testamentary. This involves a preliminary valuation of all assets in the estate.

Formal Appraisal Requirements

You’ll need professional appraisals if:

The probate court can order appraisals at any point during the process. Executors must follow the Illinois Probate Act rules for managing estate finances and assets.

Timeline Considerations

| Asset Type | Appraisal Timing |

| Real Estate | Before sale or distribution |

| Business Interests | Within 90 days of the appointment |

| Personal Property | As needed for disputes |

| Securities | At the date of death value |

If you’re dealing with complicated assets, you can ask the court for more time. Judges usually grant extensions when you have a good reason, like a tough appraisal or a lack of available experts.

You need all appraisals completed before filing the final account with the probate court. Estate administrators must maintain organization from start to finish.

Serving as an executor in Illinois? Whitsitt & Associates provides reliable estate appraisal services to help you meet deadlines and avoid legal stress. Contact us to get started.

First, the executor must compile a comprehensive list of estate assets by cataloging everything the deceased owned. Some things need professional appraisals, others are easier to value.

Real property typically requires appraisals to determine its fair market value at the time of death. Illinois probate courts want professional real estate appraisals for all types of property.

As executor, you should identify:

Licensed Illinois appraisers must handle real estate appraisals. They examine recent sales, property condition, and local market trends.

Each property gets its own appraisal report. Try to get these started early—they can take a few weeks.

High-value personal property needs a professional appraisal for accurate values. Big-ticket items require the right experts.

Vehicles that might need appraisal:

Personal items to consider:

You might need several appraisers for different categories. An art expert won’t know coins, and a jewelry appraiser isn’t your go-to for antiques.

Everyday household items like basic furniture or clothes usually don’t need an appraisal—unless, of course, they’re rare or valuable.

Business interests and intellectual property require specialized valuation methods to determine their worth at death. These assets can comprise a significant portion of the estate.

Business assets might include:

Intellectual property assets:

Certified business valuators handle these types of appraisals. They use income, market, and asset-based approaches. Honestly, these can get pricey and complicated, but they’re necessary.

Gather all business financials, tax returns, and agreements to help your appraiser out.

Modern estates often include digital assets, which require special attention to locate and assess their value. They’re easy to overlook, but sometimes they’re worth a lot.

Cryptocurrency holdings:

Online business assets:

The executor needs to track down digital wallets, exchange accounts, and online business records. Crypto values change rapidly, so timing is crucial.

Professional digital asset appraisers know blockchain, online businesses, and domain valuation. They use specialized tools to get accurate numbers.

Picking qualified appraisers is crucial for solid estate valuations in Illinois. You need to hire licensed professionals who follow industry standards and can back up their reports if challenged.

Illinois requires real estate appraisers to have a state license. They also need to follow the Uniform Standards of Professional Appraisal Practice (USPAP).

USPAP keeps the appraisal up to federal and state legal standards. That way, you’re protected against challenges from heirs or the IRS.

What should you check?

Ask appraisers if they’ve handled estates before. Some estate appraisals need special steps you won’t see in a regular home appraisal.

If you’re unsure where to start, consult with your attorney. Lawyers typically know which appraisers are qualified to handle estate work and can provide the necessary documentation for the court.

Different types of property require other expertise. A real estate appraiser just can’t properly value jewelry, art, or antiques.

Common items needing specialized appraisers:

Each specialist should have the right certifications for their field. For instance, jewelry appraisers should have credentials from recognized gemological institutes.

Estate executors must identify which items require professional appraisal based on value and complexity. High-value items always need expert evaluation.

The executor can work with several appraisers for different asset types. This way, each item gets a fair evaluation from someone who actually knows the category.

Every appraisal needs a formal written report. Verbal estimates or quick letters won’t meet legal requirements for estate proceedings.

Required report elements:

The report must clearly state the property’s fair market value as of the date of death. This becomes the stepped-up basis for tax purposes.

Executors should collect supporting documentation, such as property deeds and receipts, to help appraisers draft and finalize accurate reports. This makes things faster and more precise.

The written report protects the executor from liability. It demonstrates that they exercised professional judgment in determining the asset values for the estate.

Executors must maintain precise documentation for every appraised asset, including date-of-death values and supporting evidence. A well-organized system is crucial for accurate tax filings.

Professional appraisers determine the value of the estate through careful documentation that meets both Illinois probate court requirements and federal tax standards.

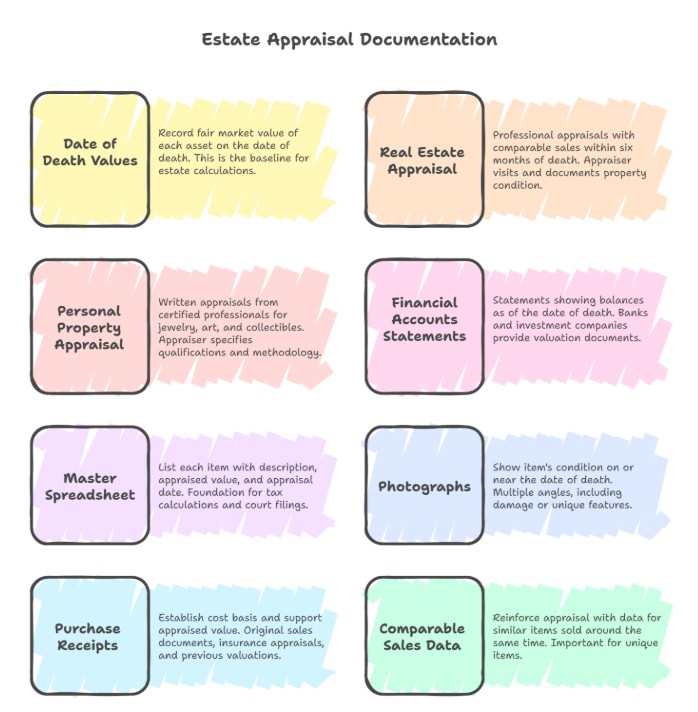

The executor must record the fair market value of each asset as of the exact date the person died. This date can’t be changed and serves as the baseline for all estate calculations.

Real estate requires professional appraisals that include comparable sales within six months of the death date. The appraiser should visit the property and document its condition on the valuation date.

Personal property, such as jewelry, art, and collectibles, requires written appraisals from certified professionals. The appraiser should specify their qualifications and explain their methodology.

Financial accounts need statements showing balances as of the date of death. Banks and investment companies can provide these specific valuation documents if requested.

The executor should set up a master spreadsheet that lists each item, including its description, appraised value, and appraisal date. This spreadsheet becomes the foundation for all estate tax calculations and probate court filings.

Documentation beyond the appraisal report enhances the valuation and provides protection against IRS challenges. Executors must retain records that demonstrate proper handling of all assets and their valuation reports.

Photographs should show the item’s condition on or near the date of death. Take shots from multiple angles and include any damage, wear, or unique features that could affect value.

Purchase receipts help establish cost basis and support the appraised value. Original sales documents, insurance appraisals, and previous professional valuations also provide useful context.

Comparable sales data for similar items sold around the same time reinforce the appraisal. This is especially important for unique items such as antiques, art, or collectibles.

The executor should organize this supporting documentation in folders for each appraised item. Digital copies are handy for backup and sharing with attorneys or tax preparers.

Large estates are required to file federal Form 706, which necessitates extensive documentation of all appraised values. Illinois also requires specific documentation for state estate tax purposes if the estate is big enough.

Form 706 requires detailed schedules that list real estate, stocks, bonds, and personal property, along with complete descriptions and values. The IRS expects supporting appraisals for items over $3,000.

Illinois requirements include similar documentation for estates exceeding the state filing threshold. The executor must provide appraisals that meet both federal and state standards at the same time.

The organizational system should categorize items to match the tax form schedules. Set up folders for real estate (Schedule A), stocks and bonds (Schedule B), and personal property (Schedule F).

Keep detailed records of time spent and activities conducted on behalf of the estate, including all appraisal-related work. The court and beneficiaries might ask for this information during the administration process.

Need accurate valuations that meet Illinois probate court standards? Whitsitt & Associates specializes in residential and complex estate appraisals. Schedule your consultation today.

The executor must file the completed inventory with the probate court handling the estate. This step makes the inventory official and part of the court record.

Illinois law gives executors 60 days from their appointment to file the inventory. Miss the deadline, and the court might sanction or even remove the executor.

The filing package includes several key documents:

The probate court reviews the inventory to make sure it’s complete. The court ensures that all assets are correctly accounted for and accurately valued.

Most Illinois probate courts charge a filing fee for the inventory. The executor should contact the court clerk to verify the current filing fee before proceeding.

The executor must give copies to all beneficiaries and interested parties. Some courts want proof showing that copies were distributed correctly.

Once filed, the court will either accept the inventory or request additional information. The executor may need to provide extra documentation if the court has questions about certain assets or valuations.

Sharing appraisal results with heirs takes clear communication and transparency to prevent disputes.

Executors must present values honestly and explain complex valuation methods when heirs request them.

The executor should prepare a clear summary of all appraised assets before contacting heirs. List each item or property category with its determined fair market value.

Key information to include:

Present the information in an organized format. A simple table usually does the trick for most estates.

| Asset Type | Description | Appraised Value |

| Real Estate | 123 Main St, Chicago | $450,000 |

| Jewelry | Diamond ring collection | $15,000 |

| Artwork | Oil painting set | $8,500 |

Send this summary to all heirs at the same time. That helps prevent confusion and demonstrates that the executor is treating everyone equally.

Include copies of the actual appraisal reports with the summary. Heirs have the right to look over the full documentation.

Some heirs might question appraisal values, especially for items with sentimental value. The executor should be ready to explain how appraisers determine fair market value.

Common valuation methods include:

If an heir disagrees with an appraisal, explain that estate appraisals provide objective assessments of property value. The appraiser uses professional standards, not personal opinions.

Document any questions or concerns heirs raise about valuations. This creates a record in case disputes arise later on.

Remember, sentimental value is different from market value. A family photo might be priceless to one person but have no market value for estate purposes.

Emotions often run high during the estate settlement process. The executor should stay calm and professional when discussing appraisal results with heirs.

Best practices for communication:

If heirs get upset about values, acknowledge their feelings but explain the legal requirements. Illinois probate law requires accurate valuations, even if family members wish it were different.

Put all significant communications in writing. Follow up phone calls with email summaries of what you discussed.

If conflicts escalate, suggest that unhappy heirs talk to their own attorney. The executor should follow the correct procedures and remain respectful to everyone involved.

Estate appraisal mistakes can delay probate, create legal headaches, and hurt relationships with beneficiaries.

The biggest problems typically arise from delays, the use of unqualified appraisers, the mixing of personal and estate finances, and poor communication.

Executors should order appraisals soon after their appointment. Illinois probate courts expect appraisals within certain timeframes. If you wait too long, the whole probate process can stall.

Common executor mistakes often include procrastination on key tasks. Property values can change over time, and courts require accurate values as of the date of death, not months later.

Timeline Requirements:

Late appraisals can be frustrating for beneficiaries who are waiting for distributions. They might also mess up tax calculations and deadlines. The executor could even face court sanctions for unreasonable delays.

Only certified appraisers should be authorized to value estate properties. Illinois courts actually expect specific credentials for different assets.

If you use unqualified appraisers, the appraisal might not hold up in court. That’s a headache you just don’t need.

Real estate appraisers are required to hold a valid Illinois state license. Personal property appraisers need certifications from recognized organizations.

Business valuations require specialized credentials. The paperwork alone is enough to make your head spin.

Required Certifications:

Courts frequently reject appraisals from uncertified individuals. Executors end up starting over with someone qualified.

This wastes time, drains money, and irritates beneficiaries. Nobody wants that mess.

Executors must keep the estate property completely separate from their own belongings. Avoiding common executor mistakes means paying attention to every dollar.

Don’t ever deposit estate checks into your personal account. Paying estate bills out of your own pocket and hoping for reimbursement? That’s not a great plan.

Keep detailed records of every transaction. It’s tedious, but it matters.

Separation Requirements:

Mixing assets opens the door to legal trouble for the executor. Beneficiaries might start to wonder if something shady is going on.

The court could even remove executors who fail to maintain order. It’s just not worth the risk.

Beneficiaries have a right to know about estate appraisals. Common mistakes executors make often stem from poor communication.

Share those appraisal reports as soon as you get them. Explain the process and timeline, even if it’s a little awkward.

Answer questions about property values honestly. People appreciate straight answers, even if they’re not thrilled about the numbers.

Communication Best Practices:

Transparency goes a long way in building trust. When you hide info, beneficiaries start to get suspicious—who wouldn’t?

Illinois law requires executors to act in the best interests of the beneficiaries. That’s just how it is.

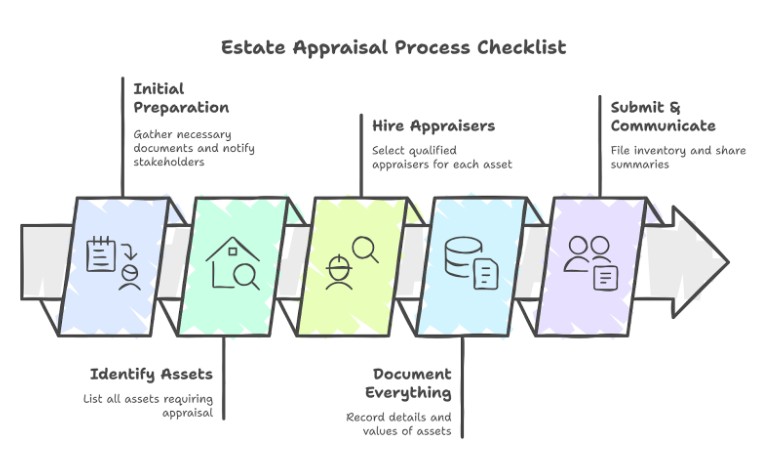

| Phase | Checklist Item |

| 1. Initial Preparation | ▢ Obtain Letters of Office from the probate court |

| ▢ Mark your 90-day inventory deadline. | |

| ▢ Review will/trust for appraisal requirement.s | |

| ▢ Gather financial documents and property records. | |

| ▢ Notify co-executors or legal counsel, if applicable | |

| 2. Identify Assets to Be Appraised | ▢ Real estate (home, rental, land, etc.) |

| ▢ Vehicles (cars, boats, RVs) | |

| ▢ Personal property (art, jewelry, antiques) | |

| ▢ Business interests or stock ownership | |

| ▢ Digital assets (crypto, domains, online income) | |

| ▢ Safe deposit box contents | |

| ▢ Sentimental or disputed items | |

| 3. Hire the Right Appraisers | ▢ Select licensed Illinois appraisers (USPAP-compliant) |

| ▢ For specialty items, use niche appraisers. | |

| ▢ Confirm turnaround time meets 90-day window.w | |

| ▢ Request signed, written appraisal reports | |

| 4. Document Everything | ▢ Take clear photos of valuable items |

| ▢ Record date-of-death fair market values | |

| ▢ Save receipts, comparables, and supporting docs. | |

| ▢ Organize appraisals by asset category. | |

| ▢ Retain records for IRS Form 706 and court filings | |

| 5. Submit & Communicate | ▢ File the inventory with the probate court within 90 days |

| ▢ Share appraisal summaries with beneficiaries | |

| ▢ Store all appraisal records for tax and audit readiness. |

Missing the 90-day appraisal deadline in Illinois can be a significant challenge for executors. The court usually asks for extra documentation to explain why you’re late.

You may be required to request an extension from the court and notify beneficiaries. Repeated delays can result in court sanctions or removal as executor.

Immediate Actions Required:

If you miss the deadline, you’ll need to demonstrate to the court that you had a valid reason. Maybe you were sick, couldn’t find certain assets, or ran into tricky valuation problems—those are all valid explanations.

Potential Consequences:

| Issue | Impact |

| Court penalties | Possible fines or sanctions |

| Beneficiary complaints | Legal challenges to the executor’s performance |

| Extended probate | Delayed estate distribution |

Judges have some leeway and might accept a late appraisal. They’ll review what you did to resolve the issue and why the delay occurred in the first place.

You should file a motion to accept a late appraisal. Include the completed inventory, the appraisal, and a sworn statement about the delay.

Sometimes, the court asks executors to post an extra bond. That just protects beneficiaries if the delay causes issues.

At this point, you probably want professional help. A good probate attorney can help you deal with the court and keep things from getting worse.

Navigating probate appraisals doesn’t have to be overwhelming. Whitsitt & Associates handles Illinois estate valuations with care, speed, and precision. Contact us to schedule your appraisal now.

What is the deadline for filing an estate inventory in Illinois?

Illinois executors must file an estate inventory, including appraised values, within 90 days of being appointed by the probate court.

What types of assets require an appraisal during probate in Illinois?

Assets that require appraisal include real estate, vehicles, collectibles, business interests, digital assets, and valuable personal property owned solely by the deceased.

Can an executor appraise estate property themselves in Illinois?

No. Executors must use qualified, certified appraisers who follow USPAP standards for valuations that are legally accepted in probate and IRS filings.

What happens if an executor misses the 90-day inventory deadline?

Missing the 90-day deadline may result in court sanctions, loss of executor privileges, or disputes with beneficiaries. Extensions must be formally requested.

How much does a probate appraisal cost in Illinois?

Costs vary based on asset type and complexity. Residential real estate appraisals typically range from $400 to $700, with additional fees for complex or commercial properties.

Are digital assets included in Illinois estate appraisals?

Yes. Digital assets such as cryptocurrency, websites, and monetized accounts must be identified and valued if they are part of the probate estate.

What documents should an executor keep from the appraisal process?

Executors should keep appraisal reports, receipts, item photos, comparable sales data, and correspondence with appraisers to support tax filings and defend asset values.