Originally published: December 2025 | Updated: January 2026

Commercial property owners in Illinois must navigate a complex valuation system. It directly affects tax bills, financing, and every major investment decision you make.

Unlike residential properties, which mostly rely on comparable sales, commercial properties are assessed using specialized methodologies. These methods look at income potential, replacement costs, and current market conditions.

Suppose you understand how appraisers determine the value of commercial property in Illinois. In that case, you’ll be in a much better position to challenge unfair assessments or avoid mistakes that could drive up your tax bill.

The valuation process matters even more when you realize that property taxes often represent the biggest expense in owning commercial real estate. Plenty of owners find out too late that their property was valued incorrectly and end up overpaying for years.

Learning the three primary valuation approaches—and how they fit different property types—gives you the tools to protect your investment.

In Illinois, commercial appraisers consider three factors—what your property earns, what similar buildings sell for, and what it would cost to replace—to estimate fair market value for loans, sales, and tax planning.

The Three Primary Valuation Approaches:

The income approach is the most common method assessors use in Cook County for commercial real estate. It makes sense—this method lines up with how most investors actually think.

Property type really matters. Office buildings, retail, and industrial spaces all come with their own evaluation quirks.

Location also plays a huge role. A property in downtown Chicago isn’t going to be valued the same way as one out in the sticks.

Professional appraisers and county assessors check out a bunch of factors during the process:

Knowing these valuation methods helps you know what to expect during assessments. The chosen method usually depends on the property type and the available market data.

Counties use mass appraisal techniques for assessment purposes. These standardized approaches let them quickly evaluate a ton of properties and maintain consistency across similar types.

Whitsitt & Associates helps Illinois commercial owners replace guesswork with clear, defendable valuations backed by local market data and experience. Contact us.

Almost every Illinois commercial appraisal blends three approaches: income, sales comparison, and cost. Each method looks at the same property from a different angle.

The income approach focuses on how much income a property can generate for its owner. This method fits best for properties that actually generate rental income—think office buildings, shopping centers, or apartments.

Appraisers start by calculating Net Operating Income (NOI). That’s total rent collected, minus operating expenses like maintenance, property taxes, and insurance. Mortgage payments don’t factor in here.

After getting the NOI, appraisers divide it by a capitalization rate (cap rate). The cap rate is basically the return investors expect. If a property pulls in $100,000 in NOI and the cap rate is 7%, you’re looking at a value of about $1.4 million.

This method is popular because investors care most about cash flow. More income means higher value. The income capitalization approach provides a clear picture of value based on income.

This method compares your property to similar buildings that have sold nearby. Appraisers hunt for properties with a similar size, age, location, and condition.

They find comparable sales (or “comps”) and then adjust prices up or down based on differences. If a comp has newer HVAC or more parking, the appraiser tweaks the value accordingly.

The sales comparison approach works best when there are plenty of recent sales to look at. It’s straightforward and fairly easy to grasp.

In active markets like Chicago, finding good comps is usually a breeze. In rural areas, though, appraisers might have to look further away or use older sales data.

The cost approach asks: What would it cost to build this place from scratch today? Appraisers add up the value of the land and the cost to construct the building.

They work out the replacement cost, meaning what it’d take to build something similar with today’s materials and standards. Then they subtract depreciation for age, wear and tear, or out-of-date features.

Say you’ve got a 20-year-old warehouse. The land is worth $200,000, and building a new one costs $800,000. If the current building has depreciated by 25%, you’d subtract $200,000, leaving a value of $800,000.

This method of commercial property valuation is best suited for newer buildings or special-use properties such as churches or schools. These places don’t usually bring in rental income and rarely sell, so the other methods just don’t work as well.

| Method | Best For | Key Question | Main Limitation |

| Income Approach | Income-producing properties (offices, retail, apartments) | How much cash does it generate? | Doesn’t work for owner-occupied or vacant properties |

| Sales Comparison | Properties with active sales markets | What did similar buildings sell for? | Needs recent comparable sales data |

| Cost Approach | New construction or special-use buildings | What would it cost to rebuild? | Doesn’t account for income potential or market demand |

Different property types rely on different valuation methods, depending on how they generate income and how buyers assess them.

Income-producing assets are usually analyzed for cash flow, while special-use buildings often require cost-based approaches.

The income approach dominates valuation for properties bringing in steady rental income. Buyers of apartments, retail centers, office buildings, and industrial facilities focus primarily on net operating income.

Investors figure value by dividing annual net operating income by the cap rate for similar properties in that market.

For example, a retail property generating $200,000 in NOI in a 7% cap rate market would be valued at around $2.86 million.

The sales comparison approach acts as a sanity check. Brokers and appraisers compare the subject property to recent sales of similar buildings in the area.

Cap rates can vary widely by property type and location. Industrial buildings in Illinois might go for 6–7% cap rates, while older office buildings could be 8–9% or even higher.

Properties built for specific uses usually rely on the cost approach for valuation. That includes churches, medical clinics, manufacturing plants, and owner-occupied spots.

The cost approach adds up what it’d take to replace the building now and knocks off depreciation. Appraisers value the land separately and tack it onto the depreciated building value.

This method shines when there just aren’t enough comparable sales. If you’ve got a specialized medical building with custom surgical suites, good luck finding a direct comp—so the cost approach becomes the go-to.

Common special-use properties in Illinois:

Properties with multiple income streams or unique quirks usually need a blend of methods. For example, a building with retail below and apartments above needs separate analysis for each part.

Appraisers might use the income approach for rental units and the cost approach for owner-occupied space. They’ll reconcile the numbers into a single value at the end.

Development sites add another wrinkle. The residual land value method figures out what a developer could pay for the land by subtracting construction costs and profit from the finished project’s value.

Properties in transition—like an old factory being converted into lofts—need multiple approaches, too.

An owner converting a factory would want to consider both renovation costs and the income those new units might generate.

Get a realistic view of your property’s worth with unbiased appraisals from Whitsitt & Associates, tailored to complex Illinois commercial deals—schedule an appointment.

A commercial appraiser starts by gathering property info and ends by delivering a detailed valuation report.

The job breaks down into three main phases: preparing documents before the site visit, conducting a thorough on-site inspection, and completing the analysis to determine market value.

The appraiser starts by collecting basic information about the property. They need the address, legal description, and the reason for the appraisal.

They gather documents like old appraisals, tax assessments, lease agreements, and income statements. Property deeds, surveys, and building plans help them nail down the property’s physical and legal details.

The appraiser checks out comparable properties in the area to get a feel for the market. Cook County uses mass appraisal methodologies for commercial properties, often leaning on the income approach.

Knowing how local assessments work helps the appraiser stay in line with regional standards. They confirm the scope of work and set a timeline with the client.

The appraiser also clarifies which valuation methods fit the property type and the report’s purpose. Not every method works for every property, so they pick the one that makes sense.

The appraiser visits the property to check its condition and features. They measure the building, note the layout, and monitor construction quality.

During the property inspection, they look at:

The appraiser takes photos and detailed notes. They monitor any depreciation or value loss that could affect the property.

They also double-check that the property matches the earlier documents. It’s easy to miss something if you don’t see it in person.

The appraiser reviews all the collected data to figure out the property’s market value. They usually use one or more approaches: cost, sales comparison, or income.

Once they determine depreciation, they reconcile the different approaches. Each method is weighed based on the property type and the available data.

For office buildings and retail centers, income analysis is often used. Owner-occupied properties might get more weight on the cost approach.

The final appraisal report includes property details, market analysis, the methods used, and the concluded value. It explains how they arrived at the number and includes supporting materials like photos, maps, and comparable sales.

Lenders, buyers, sellers, and even insurance companies rely on this report for business decisions, tax appeals, and more.

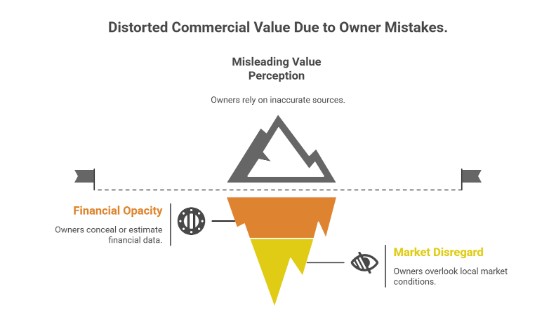

Property owners make mistakes that distort the true value of their commercial real estate. Usually, it comes down to using bad data, hiding important financials, or ignoring what’s happening right outside their door.

Tax assessments and online calculators have their uses, but they don’t reflect the true market value. In Illinois, county tax assessments occur on a set cycle and may reflect property conditions from a year or more ago.

Assessors use mass appraisal techniques, applying broad formulas to tons of properties at once. Individual quirks get lost in the shuffle.

Online estimators have the same problem. They pull from public records and algorithms, but they miss stuff—like new renovations or old problems lurking under the surface.

Say you’ve got a warehouse with a new HVAC and loading docks. The online estimate might still match an identical building with outdated everything. Not exactly fair.

Bad assessment data can really skew values. If you use a tax assessment as proof of value in negotiations, buyers and lenders usually won’t take you seriously. They know these tools aren’t built for real market valuation.

Not gathering or sharing enough data is a classic owner mistake. Some folks just estimate expenses instead of pulling real numbers from their books.

Others round up or leave out parts of the rent roll, skipping lease terms or tenant improvement details. That only makes things messier.

If you hide bad news—like environmental issues or below-market rents—the appraiser will find out anyway. Being upfront and detailed protects your investment and leads to a fairer outcome.

Good financial documentation should include:

National headlines don’t tell you what’s happening on your block in Chicago, Springfield, or Peoria.

Maybe you read that industrial properties are up 8% a year, but if your neighborhood has empty warehouses everywhere, that stat doesn’t mean much.

Tracking the local market helps you avoid mistakes. You need to know about recent sales in the area, new construction that could compete, and changes in zoning or traffic patterns.

Owners sometimes overestimate their property’s position, too. Comparing a 30-year-old strip mall to a brand new retail center—without considering age or amenities—sets you up for disappointment.

Understanding the local market and your property’s specifics is key. Working with local brokers and appraisers who see what’s really happening gives you a much clearer picture.

Owners need professional appraisals at certain points in their business journey. Knowing when to call an appraiser can save money and headaches down the road.

Lenders always want a current appraisal before approving a commercial loan. Banks need to see that the property is actually worth what you say it is. They’re protecting themselves—and you—from biting off more than you can chew.

Refinancing? Same deal. Interest rates change, property values shift, and lenders want the latest info before they update your loan. That $2 million property from five years ago could be worth a lot more—or less—today.

If you’re changing partners, you’ll need an appraisal, too. When someone buys out another owner or brings in new investors, everyone wants an objective value. Otherwise, you’re just guessing at who gets what.

Sometimes, property tax assessments come in way too high. When that happens, you can appeal.

Illinois assesses commercial properties at fair market value, but the assessor’s number might not match reality.

An independent appraisal gives you the backup you need for an appeal. Courts and assessors trust professional reports that follow the rules. Without that, your chances drop fast.

Divorce, estates, and business disputes all need appraisals, too. In these cases, you want a neutral third party that both sides can rely on. The appraisal becomes a key piece of evidence when nobody can agree on value.

Sellers benefit from knowing what their property is worth before listing. An appraisal helps you set a price that attracts buyers without leaving money on the table.

For long-term owners, regular appraisals help you decide whether to hold, improve, or sell. It’s hard to plan if you don’t know where you stand.

Insurance should match the current value, too. If you’ve improved the property or the market’s jumped, an old appraisal could leave you underinsured.

Business planning, financial reporting, and portfolio analysis all rely on up-to-date values. Otherwise, you’re just guessing.

| Trigger Event | Why An Appraisal Helps |

| Loan application | Verifies value meets lender requirements |

| Refinancing | Updates the value for the new loan terms |

| Partner buyout | Provides an objective price for ownership transfer |

| Tax appeal | Supplies evidence to challenge the assessor’s valuation |

| Divorce or estate | Creates a neutral valuation that both parties accept |

| Property sale | Sets a realistic asking price |

| Insurance review | Ensures adequate coverage amounts |

| Portfolio planning | Tracks investment performance over time |

Whitsitt & Associates is a full-service real estate appraisal practice in Champaign, Illinois.

Stephen Whitsitt started the company over 40 years ago. That’s a long time to be in the business.

The firm appraises all varieties of properties—residential, commercial, industrial, retail, and vacant land.

They also provide tax appeal services and consulting for clients nationwide. It’s not just local work.

The team at Whitsitt & Associates includes licensed appraisers with professional designations.

Each appraiser holds certification through the State of Illinois. Some on the team have earned specialized credentials, such as MAI and SRA.

Whitsitt & Associates handles complex property appraisals that need detailed analysis.

They work on valuations for a bunch of commercial property types, including:

The firm also provides estate valuations and PMI removal appraisals.

Their appraisers sometimes serve as expert witnesses in legal proceedings.

Local Market Knowledge

They’ve worked in Central Illinois for over 4 decades, giving them profound insight into the local market.

The company understands how Illinois commercial real estate appraisers navigate economic changes and legal requirements.

That experience helps them deliver accurate property valuations that reflect current market conditions.

Ready to move forward with confidence on financing, selling, or tax appeals? Secure a thorough commercial valuation today with Whitsitt & Associates. Contact us.

How is commercial property valued in Illinois?

Commercial property in Illinois is valued using three main methods: the income approach, sales comparison approach, and cost approach. Appraisers look at what the property earns, what similar properties sell for, and what it would cost to replace, then reconcile those into a single market value.

What are the main commercial property valuation methods used in Illinois?

The main commercial valuation methods in Illinois are the income approach, sales comparison approach, and cost (or replacement) approach. Together, they analyze income, comparable sales, and replacement cost minus depreciation to estimate a defensible fair market value.

Which valuation method is most common for income-producing commercial properties in Illinois?

For income-producing properties in Illinois, the income capitalization approach is most commonly used. Appraisers calculate net operating income (NOI) and apply a market-derived capitalization rate to convert that income stream into a value indication.

How does Illinois property tax assessment relate to commercial property value?

Illinois commercial property tax assessments are based on a percentage of fair market value, with most counties using about 33⅓% % and Cook County using classified rates. If the underlying market value estimate is high, the assessed value and resulting tax bill will also be higher.

What information does an appraiser need to value my commercial property in Illinois?

To value an Illinois commercial property, an appraiser typically needs rent rolls, leases, 2–3 years of income and expense statements, property tax bills, and details on improvements. Accurate financials and up-to-date occupancy data are essential for a reliable income-based valuation.

How often should I have my Illinois commercial property valued?

Most owners in Illinois order a new commercial appraisal every 3–5 years, or sooner if they refinance, plan a sale, buy out a partner, complete major renovations, or see big market shifts. Any major decision tied to value should be based on a current appraisal.

Can a commercial appraisal help with an Illinois property tax appeal?

Yes. A professional commercial appraisal can strongly support an Illinois property tax appeal if your assessment appears higher than market value. It documents income, expenses, cap rates, and comparable sales to support a reduced assessment.