Originally published: July 2025 | Updated: January 2026

Talking to a home appraiser in Central Illinois is a big step when you’re selling or refinancing. Clear, honest conversations help avoid confusion and can make the appraisal go much smoother.

Homeowners and real estate agents should know what’s okay to discuss with appraisers. Laws and professional rules shape these conversations, so it’s not a free-for-all.

Central Illinois has its real estate quirks, so a little prep goes a long way. If you’ve made upgrades or major repairs, or know something unique about your neighborhood, sharing that can help the appraiser see the full value of your place.

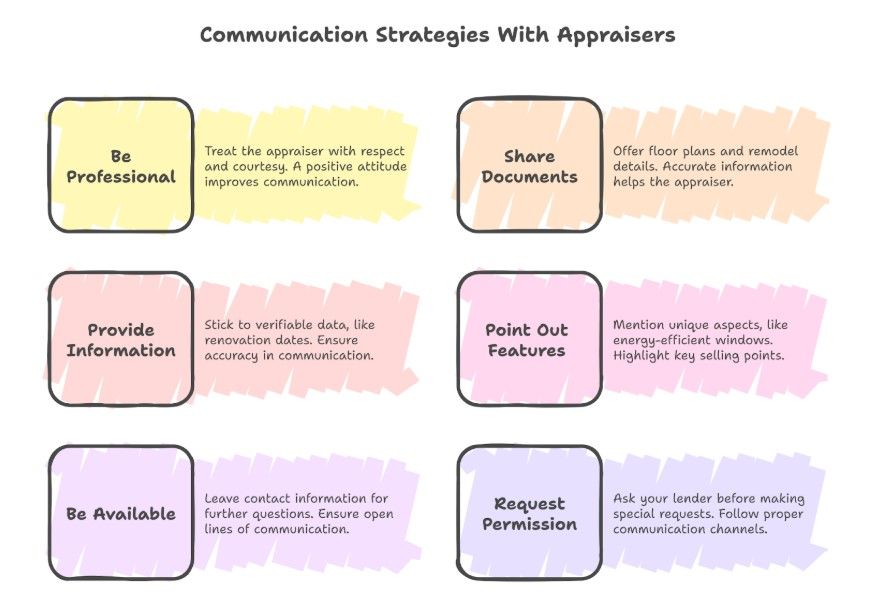

Staying organized and being polite during the visit shows you’re serious. It sets the right tone for a positive experience.

Clear communication with your appraiser helps ensure everyone is on the same page regarding the home’s condition and features.

Sharing the right info at the right time helps the appraised value actually reflect the real situation.

Open, honest conversations matter if you want an accurate appraisal. If you’ve got receipts for repairs or upgrades, hand them over—the more facts, the better.

When the appraiser asks questions, just answer directly and stick to the facts. Trying to sway them with opinions or emotions doesn’t help, and honestly, it can backfire. Staying polite and providing evidence gives the appraiser a clear, unbiased picture.

Your home’s appraised value can shape major decisions, including buying, selling, refinancing, and even your property taxes.

For buyers and sellers, a fair appraisal keeps the sale price in check. If it comes in too low, securing a loan or closing the sale can become tricky quickly.

When refinancing, showing the appraiser what’s new or improved can help you qualify for better loan terms. Supporting documents and clear details go a long way in providing clarity.

Appraisals also affect your property taxes. If you forget to mention something, your home might get valued too high or too low, which could mean you’re paying too much or too little. Being upfront with appraisers helps keep your taxes fair.

Local job opportunities, neighborhood changes, and buyer preferences shape Central Illinois’ real estate scene.

Lately, median home prices and inventory have held steady. These shifts all contribute to how appraisers determine property value.

Median home prices in many Central Illinois cities usually land between $160,000 and $200,000.

Some counties have experienced slight price increases, particularly near new job opportunities. Inventory is still pretty tight, so buyers and sellers are on more equal footing.

The months of inventory usually sit between 2 and 4 months. Homes typically spend about 30 to 50 days on the market.

Mortgage rates in Illinois have hovered between 6% and 7% throughout 2024 and into 2025. All of this shapes what buyers can afford and how quickly homes sell.

If you own a home, these numbers matter when you get a home appraisal. Appraisers examine recent sales, local comparable sales, and market trends.

When inventory is low, values tend to remain high because buyers are competing for fewer homes. If median prices go up, so will most appraisals.

Appraisers in Central Illinois closely monitor nearby sales and the speed at which homes are sold. Mortgage rates affect what buyers can afford, which can nudge appraised values up or down. Location, size, and property condition still matter most.

Keeping an eye on these trends helps you know what to expect from an appraisal. It also makes it easier to have a genuine conversation with your appraiser about how they arrived at the value.

The home appraisal process in Central Illinois brings in a licensed professional to put a market value on your property. Buyers, sellers, and lenders all rely on this step to make deals and approve loans.

A home appraisal is an official estimate of a property’s current value, conducted by a licensed appraiser. This person isn’t your agent—they’re an independent third party trained for Illinois properties.

Most home sales, refinances, and tax assessments require an appraisal. Lenders want to know the property’s value matches (or beats) the loan amount. The appraiser examines the home’s size, condition, updates, and recent sales of similar properties in the area.

In Central Illinois, factors such as local trends and special features can influence your value either positively or negatively.

Step 1: Scheduling and Preparation.

The lender or buyer hires a licensed appraiser and sets up a visit. Homeowners tidy up, make minor repairs, and gather documents related to any recent improvements.

Step 2: Property Inspection.

The appraiser inspects both the interior and exterior of the home. They measure the rooms, examine the condition, note features, and take photos for the report.

Step 3: Conducting Market Research and Analyzing Comparable Sales.

Next, the appraiser studies recent sales of similar homes in Central Illinois. These “comps” show what buyers have actually paid in your area.

Step 4: Valuation and Report.

After crunching the numbers, the appraiser writes up a report with details, photos, and their final value estimate. The lender or the person who ordered the appraisal receives a copy.

Selling, refinancing, or settling an estate? Whitsitt & Associates provides professional home appraisal services trusted across Central Illinois since 1983. Share your goals and gain expert insights—contact us to get started.

Appraisers in Illinois adhere to strict legal and professional standards. These standards protect property owners and maintain fair and credible home values.

All residential appraisers in Illinois are required to be licensed or certified. The Illinois Department of Financial and Professional Regulation (IDFPR) oversees this process and establishes the rules.

Appraisers must complete classes, pass an exam, and gain hands-on experience before working independently.

There are different license levels, like trainee and certified residential appraiser. They need to keep their license up to date with continuing education every renewal period.

Anyone can check an appraiser’s credentials using the IDFPR license lookup.

Here’s a quick table of license levels in Illinois:

| License Level | Education Needed | Exam Required | Renewals / CE |

| Trainee Appraiser | Yes | No | Yes / Yes |

| Certified Residential Appraiser | Yes | Yes | Yes / Yes |

| Certified General Appraiser | Yes | Yes | Yes / Yes |

Every Illinois appraiser is required to follow the Uniform Standards of Professional Appraisal Practice (USPAP).

These national guidelines influence how appraisers develop and present their opinions. USPAP instructs them on how to utilize data, prepare reports, and mitigate bias or conflicts.

The IDFPR ensures that appraisers adhere to USPAP. They must take an update class every two years to stay current with rule changes and address emerging ethical questions.

If an appraiser ignores USPAP, they may lose their license or face suspension.

USPAP also means that appraisers need to keep accurate records, explain their reasoning, and maintain client information privacy at all times.

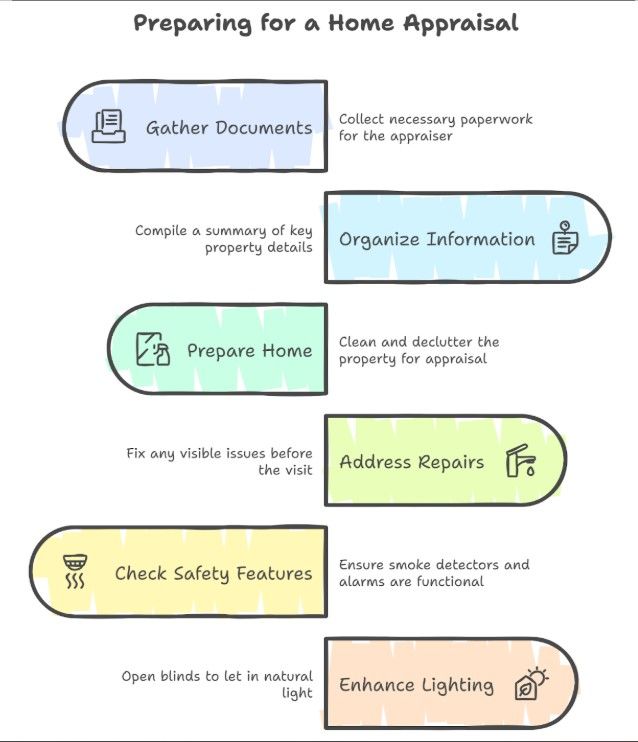

Preparing for a home appraisal in Central Illinois requires some planning. If you’re organized and your home looks its best, you’ll help the process go smoothly—and maybe even support a fair value.

Appraisers require a clear understanding of the property’s key features and recent updates. Homeowners should gather important documents, such as the deed, recent tax assessments, and a list of recent improvements.

This information helps the appraiser verify details and compare the home to others in the area. Having everything ready just makes life easier.

Receipts or permits for major projects—such as roof replacements, kitchen remodels, or HVAC upgrades—are worth gathering.

A simple folder or summary of these documents allows you to answer questions quickly if the appraiser needs more information.

This is especially true in Central Illinois, where upgrades like energy-efficient windows can impact the appraisal—one of those little things that could tip the scale.

Here’s a quick checklist of helpful documents:

| Document Type | Example or Purpose |

| Proof of ownership | Deed or title |

| Tax documents | Recent property tax assessment |

| Improvement records | Receipts, permits, contractor invoices |

| Utility bills | For demonstrating energy savings |

First impressions count during a home appraisal. Homeowners should ensure the property is clean, clutter-free, and easy to navigate.

Standard prep includes mowing the lawn, sweeping walkways, and tidying up the main living spaces. It’s not rocket science, but it helps.

Let the appraiser into every area they ask about—the basement, attic, and garage included. If you spot repairs, such as leaky faucets, chipped paint, or broken fixtures, address them ahead of time. That way, the appraiser can focus on what’s good about the house.

Check the basics: smoke detectors and carbon monoxide alarms—make sure they are working properly. Open blinds or curtains to let in natural light. These small things can brighten up the place and set a positive tone.

What should you say to your appraiser? Whitsitt & Associates helps homeowners navigate the entire property appraisal process with clarity and confidence. Stay prepared—schedule your consultation today.

Homeowners and Realtors should focus on clarity, accuracy, and respect when meeting with appraisers.

Presenting helpful facts and clear documentation usually leads to smoother appraisals.

After the appraiser finishes the report, review the details carefully—especially if the value is lower than you hoped. Knowing what you can dispute and how to follow up helps you avoid surprises.

Once the appraisal report is ready, the lender or real estate agent sends you a copy. The report lists the appraised value, compares similar home sales, and notes the property’s condition.

Key points to check include:

If something appears incorrect, such as the number of bedrooms or missing upgrades, note it. Public records sometimes miss changes, so it’s worth double-checking the data.

Also, consider the comparable properties. Do they match your home’s style and location?

In Illinois, there’s only a short window to review and request corrections, so don’t wait. Most mistakes are rare, but accuracy is crucial if you want to discuss changes effectively.

If the value comes in significantly lower than expected, remain calm and begin gathering strong evidence. Pull together documents that show upgrades, higher neighborhood sales, or errors in the report.

Here’s what to do:

Keep communication polite and professional. Don’t argue or make it personal—just ask the appraiser to review specific points or explain their choices.

In Illinois, you can formally challenge the result, but there’s not much time. Mistakes aren’t common, but fixing them early can make a real difference.

Clear, respectful communication with a home appraiser helps the process go more smoothly.

If you’re a homeowner in Central Illinois, it’s smart to focus on sharing useful information and avoiding pressuring the appraiser.

Try to organize your records, such as receipts for renovation, in a folder. When you share these documents, you support the appraiser’s review and might even add value to the process.

If you’ve got questions about how the appraisal works, don’t hesitate to reach out to a local expert.

Make your next appraisal stress-free with Whitsitt & Associates. We deliver prompt, certified residential appraisals backed by deep local market knowledge. Book your visit now by contacting us to schedule an appointment.

What should I say to a home appraiser in Illinois?

Be honest and factual. Share upgrades, relevant documents, and local market insights. Avoid suggesting a value or influencing the appraiser’s opinion to stay compliant with USPAP standards.

Can I provide comparable sales to an appraiser?

Yes, you can share recent comparable sales, especially if they reflect unique features of your home. Provide MLS sheets or addresses—just ensure they’re objective and within 6 months.

Should I be present during the home appraisal?

You can be present, and it’s often helpful. It allows you to answer questions, point out improvements, and ensure the appraiser has access to all areas of the property.

What documents should I give to the appraiser?

Offer floor plans, property records, receipts for improvements, recent comparable sales, HOA documents, and anything that highlights the home’s value or features not easily seen.

What not to say to a home appraiser?

Avoid saying how much you “need” the home to be worth, pushing for a target value, or offering compensation tied to the appraisal result. These can appear as undue influence.

How long does a home appraisal take in Central Illinois?

The physical inspection usually takes 20 to 60 minutes. The full report, including market research and documentation, typically takes 3 to 5 business days to complete.

What factors influence home appraisal values in Illinois?

Key factors include recent comparable sales, the home’s condition, location, updates, market trends, and lot size. Appraisers use these to determine the fair market value, as per the Uniform Standards of Professional Appraisal Practice (USPAP).

Can I dispute a low home appraisal in Illinois?

Yes. Submit a formal reconsideration request with additional supporting documents or corrections of factual errors. Lenders may allow a review under specific guidelines.