Originally published: August 2025 | Updated: December 2025

What’s it really worth?” That question haunts families after a loved one dies—when memories and market value collide.

In Champaign County, the weight of estate decisions can be overwhelming: frozen assets, probate delays, and unspoken family tension.

You’re not just dealing with paperwork—you’re carrying the legacy of someone who mattered. When emotions run high, clarity matters more than ever.

A precise, professional appraisal is the difference between a smooth transfer and months of courtroom stress.

At Whitsitt & Associates, we understand you’re not just looking for numbers—you’re searching for fairness, closure, and direction. With over 40 years in Central Illinois, we bring calm to chaos, accuracy to uncertainty, and local insight that national firms can’t match.

An estate appraisal determines the fair market value of a property after someone has passed away. In Champaign County, this valuation is often required for probate filings, inheritance, and estate tax reporting.

It ensures that real estate—like a home in Urbana or farmland near Mahomet—is valued accurately and legally.

A professional, USPAP-compliant appraisal helps avoid delays, disputes, and court rejections. It provides families with clarity and ensures distributions are fair and based on facts, rather than emotions or online estimates.

Estate appraisals play a critical role in Illinois probate proceedings. Executors must submit a complete inventory of estate assets, including real estate, within 90 days of being appointed.

Courts use this valuation to determine estate tax obligations, authorize property transfers, and verify that distributions are equitable.

Without a professional appraisal, the process can stall, raise red flags, or lead to disputes among beneficiaries.

In Champaign County, probate judges prefer USPAP-compliant appraisal reports conducted by certified local professionals, not guesswork or tax estimates.

A formal estate appraisal is required in Illinois when:

Champaign County courts expect appraisals that reflect fair market value as of the date of death, performed by qualified professionals, not realtors or automated tools.

Typically, the executor of the estate is responsible for arranging the appraisal. However, it may also be ordered by:

Whether you’re navigating formal probate or preparing for private distribution, having a certified appraisal protects you from liability and gives everyone involved a clear, trusted number to work from.

If you’re responsible for managing or settling an estate in Champaign County, a certified property appraisal isn’t just helpful—it’s often required. Here’s who typically needs one:

Probate courts require accurate property valuations within 90 days. A professional appraisal helps executors avoid delays, errors, or legal challenges during estate administration.

Trust-based estates still need fair market valuations, especially when distributing real estate to beneficiaries or documenting stepped-up basis for tax purposes.

When multiple heirs are involved, an appraisal creates a neutral, fact-based value that supports fair and conflict-free decision-making.

Listing inherited property? A formal appraisal provides a reliable starting point that supports pricing strategy and answers buyer questions with confidence.

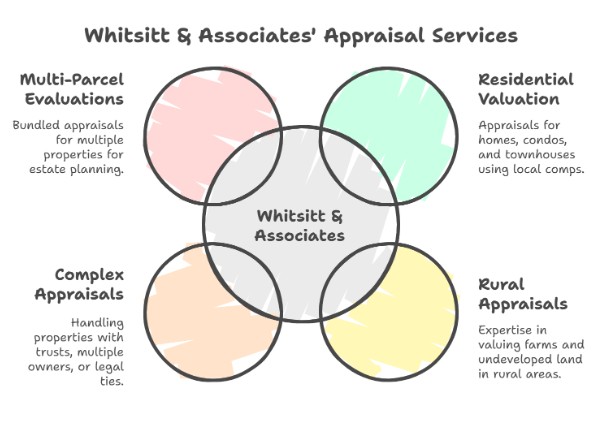

At Whitsitt & Associates, we deliver precise, court-ready appraisals tailored to the unique property types found throughout Champaign County.

From downtown homes to wide-acre parcels, our reports are accepted by Illinois courts, attorneys, and the IRS.

We appraise single-family homes, condos, and townhouses with accuracy grounded in up-to-date local comps and legal requirements.

With deep experience in agricultural valuation, we handle everything from family farms to undeveloped land across Mahomet, Rantoul, and rural townships.

We specialize in properties held in trust, owned by multiple parties, or tied to unique legal arrangements. Every scenario is handled with discretion and precision.

Whether you’re dealing with one property or several across the county, we provide bundled appraisals that simplify estate planning and meet all legal documentation needs.

You’re not just hiring an appraiser—you’re trusting someone to guide you through one of the most sensitive moments of your life.

Here’s why families, attorneys, and professionals across Champaign County choose us:

We’ve built our reputation on experience, integrity, and long-standing relationships throughout Champaign, Urbana, Mahomet, and beyond.

Our reports meet all legal standards for probate, trusts, and estate tax filings. They’re trusted by local courts, CPAs, and estate planners alike.

We don’t just work here—we live here. Our team lives in the very communities we serve. Our appraisals reflect true local market conditions, not general estimates from out-of-town firms or online calculators.

We understand time matters in probate and trust administration. That’s why we deliver clear, defensible reports—on schedule, without cutting corners.

From Urbana homes to rural Mahomet estates, Whitsitt & Associates ensures that every appraisal meets the legal, tax, and family needs of its clients. Contact us today to request your personalized estate valuation.

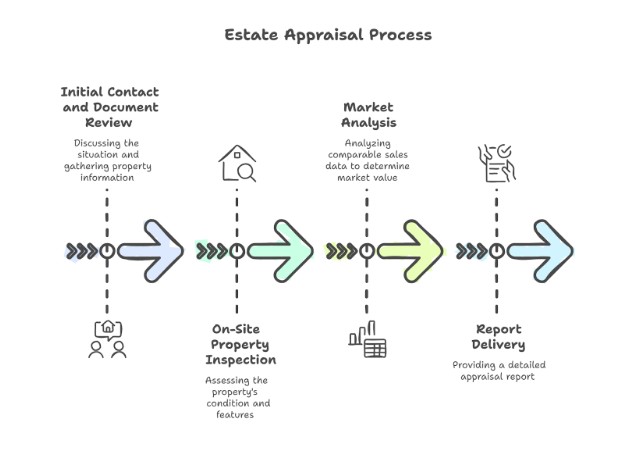

From your first call to final report delivery, we make the appraisal process simple, respectful, and fully transparent.

We’ll discuss your situation, timeline, and gather basic information about the property and estate requirements before scheduling the inspection.

A licensed appraiser will visit the property to assess its condition, features, improvements, and relevant details—both inside and out.

We utilize real-time, hyper-local comparable sales data to determine a fair market value, taking into account current market conditions and historical trends.

You’ll receive a detailed appraisal report accepted by courts, attorneys, and tax professionals. If needed, we’re available to answer questions or clarify findings.

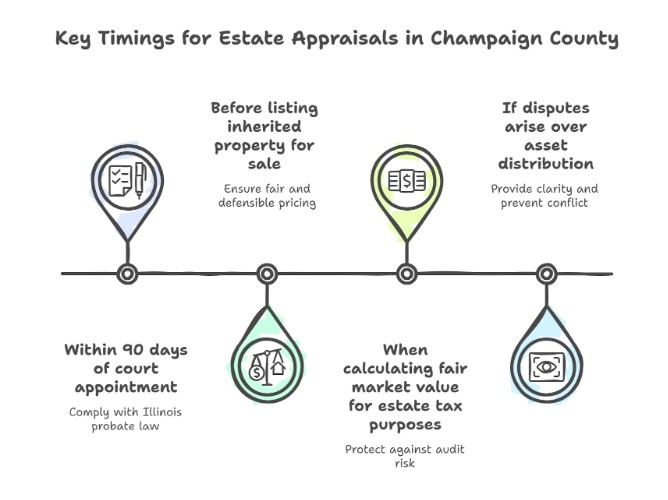

Timing is critical when it comes to estate appraisals—especially when legal filings, taxes, or family expectations are involved.

Here’s when to act:

Illinois probate law requires executors to file a complete inventory—including real estate values—within 90 days. Don’t risk delays or noncompliance.

An appraisal ensures you’re pricing the property fairly and defensibly—whether you’re selling as-is, updating, or dividing proceeds among heirs.

The IRS requires accurate “date-of-death” valuations. A certified appraisal protects you from audit risk and helps ensure accurate reporting.

When family members disagree, an unbiased third-party appraisal provides clarity and helps prevent unnecessary conflict during an already emotional process.

Whitsitt & Associates proudly provides estate appraisal services throughout the county. We understand the neighborhoods, property types, and legal expectations that come with each area.

From classic homes near the University of Illinois to newer developments, we know Champaign’s dynamic real estate market inside and out.

Historic properties, rental conversions, and residential estates are all part of Urbana’s diverse landscape—we’ve appraised them all.

Savoy’s growing residential zones require appraisers who understand both development trends and rural transitions—we cover both with ease.

Whether you’re dealing with farmland, custom homes, or large family estates, our team has extensive experience in Mahomet’s diverse rural and suburban landscape.

We serve all of Champaign County, including smaller towns and unincorporated areas. No property is too remote, unique, or complex.

Online estimators may offer a quick estimate, but when legal and financial outcomes are at stake, accuracy and credibility matter most.

We don’t rely on national averages. Our appraisals reflect actual sales, local trends, and property-specific factors in Champaign County.

Our reports follow USPAP standards and meet all court, attorney, and IRS expectations—no shortcuts, no surprises.

You’ll receive a detailed, defensible report ready for probate filings, trust administration, or estate tax calculation—delivered on time, every time.

Don’t let paperwork or delays hold up your estate settlement. Whitsitt & Associates provides fast, accurate appraisals trusted by courts, attorneys, and families across Champaign County. Contact us now to get started.

How much does an estate appraisal cost in Champaign County?

Fees vary based on property size, complexity, and location. Most standard residential appraisals range from $400 to $700. We provide custom quotes for estates with multiple properties or unique conditions.

How long does it take to receive the report?

In most cases, you’ll receive your completed appraisal within 5 to 7 business days after the inspection. Expedited options are available upon request.

Will this appraisal be accepted by the court or the IRS?

Yes. Our appraisals are USPAP-compliant and designed for legal use. They meet Illinois probate standards and are accepted by courts, CPAs, and estate attorneys.

What happens if the property was co-owned?

We evaluate the total property value and can provide partial interest appraisals when needed. This is common in estates with joint ownership, trusts, or family land divisions.